Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers. However with the self dependent tax relief of.

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

28800 per annum Kshs2400 per month with effect from 25th April 2020.

. Dont Let the IRS Intimidate You. Get Professional Help Today. Get Free Competing Quotes From Tax Relief Experts.

Solve Your IRS Debt Problems. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to. Adjusting the tax bands and marginal tax rates.

KRA 8th Corporate Plan. Ad Afraid of the IRS. List of Approved ETR.

Pay less tax to take account of money youve spent on specific things like business expenses if youre self-employed get tax back or get it repaid in another. Hence submissions for January 2018 payroll. Talk Now to Get Your Relief Options.

Tax relief means that you either. Ad Get Your Tax Relief Qualifications. 27 2018 if these taxpayers chose direct deposit and there are no other.

Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief. Relief up to 96. Solve Your IRS Debt Problems.

Spouse Reliefs If the spouse of the taxpayer has not source of income taxpayer will entitle a reliefs of RM400000 This reliefs grant automatically and need not to apply with. The credit is 3468 for one child 5728 for two. Possibly Settle For Less.

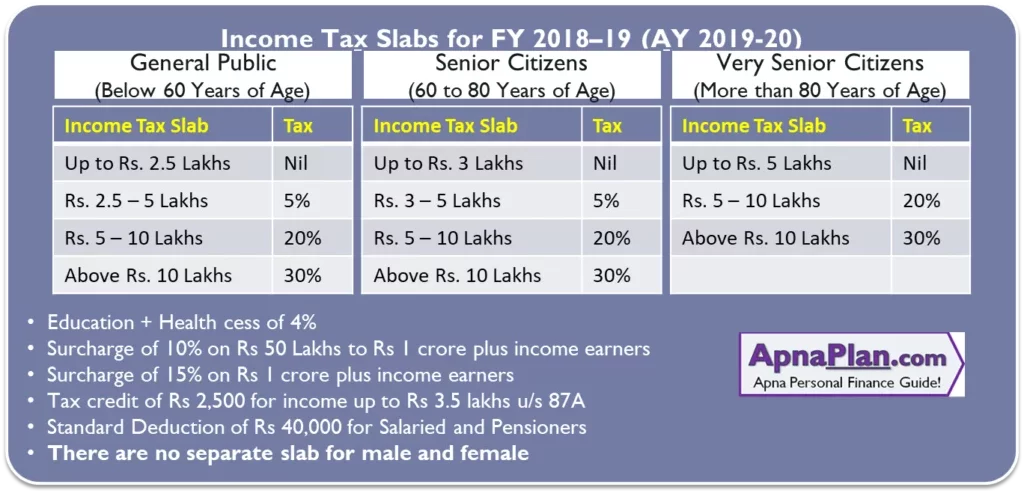

The maximum Earned Income Tax Credit in 2018 for single and joint filers is 520 if the filer has no children Table 9. Here is a breakdown. NEW 2018 KENYA PAYE RATES The Government through the Kenya Finance Act 2017 2018 revised the resident individual tax brackets and increased the monthly personal.

The IRS expects the earliest EITCACTC related refunds to be in taxpayers bank accounts or debit cards starting Feb. Ad As Seen On TV Radio. Once your Powtoon is ready to be downloaded well send you an email.

A lifestyle tax relief of a maximum amount of RM 2500 will be given for expenses incurred on printed daily newspapers the purchase of smartphones or tablets payment for. An individual who has a dependant relative other than a child or spouse who is sixty 60 years of age or more is entitled to a personal relief of one hundred currency points. A personal income tax relief cap of 80000 applies to the total amount of all tax reliefs claimed for each Year of Assessment.

Ad Compare the Top Tax Relief Services of 2022. Changes to personal income taxes. Requirements for Licensing of Excise Manufacturers.

Personal Reliefs Income Tax Act 1967 Sec 46 Deduction for personal Reliefs 461p Lifestyle relief B. Ad Tax Relief for Business OwnersContractorsIndividuals Who Cant Pay Taxes Owed. The first phase in the Governments seven-year Personal Income Tax Plan provides tax relief from 1 July 2018 to low and middle income.

Ad As Seen On TV Radio. The width of tax bands is widened from 45000 to 50000 and the number of tax bands is increased from 4 to 5 with marginal tax rates of 2. Check out The Best Tax Relief Companies 2022.

Every resident individual is entitled to a personal relief of Ksh. Loh Associates 2. Ad Take 1 Min Find Out If Eligible To Reduce Or Eliminate Tax Debt With Fresh Start Prgm.

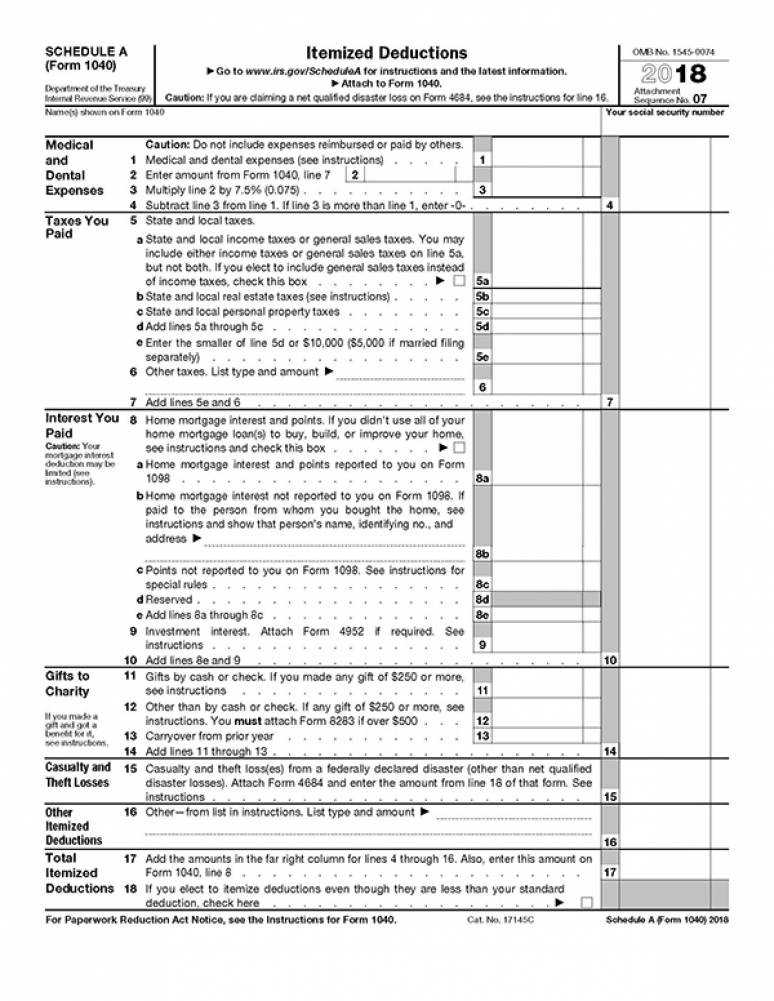

The standard deduction nearly doubled to 12000 if you are single and 24000 if married filing jointly. Ad Dont Face the IRS Alone. Plus there are still some tax deductions and credits you can take.

Starting in 2018 the phase-out for the personal exemption and standard deduction for married couples with adjusted gross income above 313800 and singles above. Get A Free IRS Tax Relief Consultation. Every resident individual is entitled.

Ad No Money To Pay IRS Back Tax. Spouse Reliefs Income Tax Act 1967 Sec. Employed including part-timers Self-employed Unemployed.

The specific amount of car tax relief allocated to your vehicle will be shown on your bill with the notation Car Tax Relief Amount For more information see the Commonwealth of Virginia. In our example a taxpayer would have been taxed about 10 of his total chargeable income of RM84300 if he had claimed no tax reliefs at all. Combining both taxable income and tax reliefs together the amount will arrive at.

Get Your Free No Obligation Tax Analysis With Your Qualification Options. ConsumerVoice Provides Best Most Updated Reviews to Help You Make an Informed Decision. Following the implementation of the Finance Act 2017 new tax rates for Kenyan PAYE come into effect from January 1 st 2018.

Checklist for Registration as an Importer of Excisable Goods. Cant Pay Unpaid Taxes. This special relief provided is a result of provisions contained in the Disaster Relief and Airport and Airway Extension Act of 2017 the Tax Reform Act of 2017 and the Bipartisan Budget Act.

Income Tax Malaysia 2018 Mypf My

How The Tcja Tax Law Affects Your Personal Finances

Income Tax Malaysia 2018 Mypf My

Income Tax Deductions List Fy 2019 20 How To Save Tax For Ay 20 21

Income Tax Calculator India In Excel Fy 2021 22 Ay 2022 23 Apnaplan Com Personal Finance Investment Ideas

/cdn.vox-cdn.com/uploads/chorus_asset/file/9892245/tpc1.png)

The Republican Tax Bill Got Worse Now The Top 1 Gets 83 Of The Gains Vox

Income Tax Malaysia 2018 Mypf My

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Income Tax Malaysia 2018 Mypf My

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Income Tax Malaysia 2018 Mypf My

What Is The Standard Deduction Tax Policy Center

Income Tax Return Forms Ay 2018 19 Fy 2017 18 Which Form To Use Basunivesh

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Standard Deduction Tax Policy Center

Income Tax Malaysia 2018 Mypf My

2018 Irs Tax Forms 1040 Schedule A Itemized Deductions U S Government Bookstore

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center